Every successful trader I've met shares one critical skill: they can read the economic tea leaves before market shifts occur. When I first started trading, I reacted to news rather than anticipating it. I'd see markets plummet and scramble to understand why, always a step behind those who seemed to know what was coming.

The difference? Those successful traders were watching leading indicators-economic signposts that signal where markets might head next. Today, I'm sharing the ten most powerful leading indicators that both the Federal Reserve and top market strategists monitor religiously. Master these, and you'll start seeing market shifts before they happen, not after.

Why Leading Indicators Matter for New Traders

Leading indicators are predictive economic metrics that change before the broader economy follows suit. They're essentially early warning systems for economic shifts that inevitably impact financial markets.

Unlike lagging indicators (which confirm trends already in progress), leading indicators give you a chance to position yourself ahead of major market movements. This forward-looking advantage is why institutional investors dedicate enormous resources to tracking them.

For new traders especially, understanding leading indicators transforms you from reactive to proactive. Instead of constantly wondering why markets moved, you'll develop an economic framework that helps explain-and even anticipate-price action.

The 10 Most Powerful Leading Indicators for Market Prediction

1. The Yield Curve

Perhaps the most respected leading indicator among serious market participants is the yield curve-specifically, the spread between 10-year and 2-year Treasury yields.

When short-term rates rise above long-term rates (creating an "inverted yield curve"), it historically signals economic trouble ahead. Since 1955, this inversion has preceded every recession with remarkable consistency, typically 12-18 months before economic contraction begins.

How to use it: Monitor the 10-year/2-year Treasury spread. When it approaches zero or turns negative, markets typically have 6-12 months of upside left before broader economic weakness emerges. The deeper and longer the inversion, the stronger the recessionary signal.

Real-world application: In early 2022, the yield curve inverted significantly. Investors who recognized this signal began shifting toward defensive positions, protecting themselves from the market declines that followed throughout the year.

More on interest rates: How Do Interest Rates Affect GDP? A Beginner Trader's Essential Guide

2. Purchasing Managers' Index (PMI)

The PMI is a monthly survey of private sector companies that measures business activity across both manufacturing and services sectors. Any reading above 50 indicates expansion; below 50 signals contraction.

What makes the PMI especially valuable is its forward-looking components-particularly new orders and employment intentions-which offer insight into business confidence and future activity levels.

How to use it: Focus on the trend, not just absolute numbers. When the PMI shows several consecutive months of decline (even while remaining above 50), it often precedes economic slowdowns and market corrections.

Real-world application: Manufacturing PMI readings began deteriorating in late 2021, well before the 2022 market correction. Traders who spotted this weakening trend reduced exposure to cyclical stocks and industrial commodities ahead of their decline.

3. Weekly Initial Jobless Claims

Unemployment data might seem intuitive, but weekly initial jobless claims provide uniquely timely insights into labor market health. Unlike monthly employment reports, this weekly reading gives traders nearly real-time feedback on employment trends.

A sustained increase in jobless claims often precedes broader economic weakness and market corrections. The Federal Reserve watches this indicator closely when making monetary policy decisions.

How to use it: Watch the four-week moving average to smooth out weekly volatility. When claims rise consistently for several weeks (especially from historically low levels), it suggests economic momentum may be fading.

Real-world application: In mid-2007, jobless claims began rising consistently from low levels, providing an early warning of the economic crisis that would fully emerge in 2008. Traders who reduced risk based on this signal avoided the worst of the market collapse.

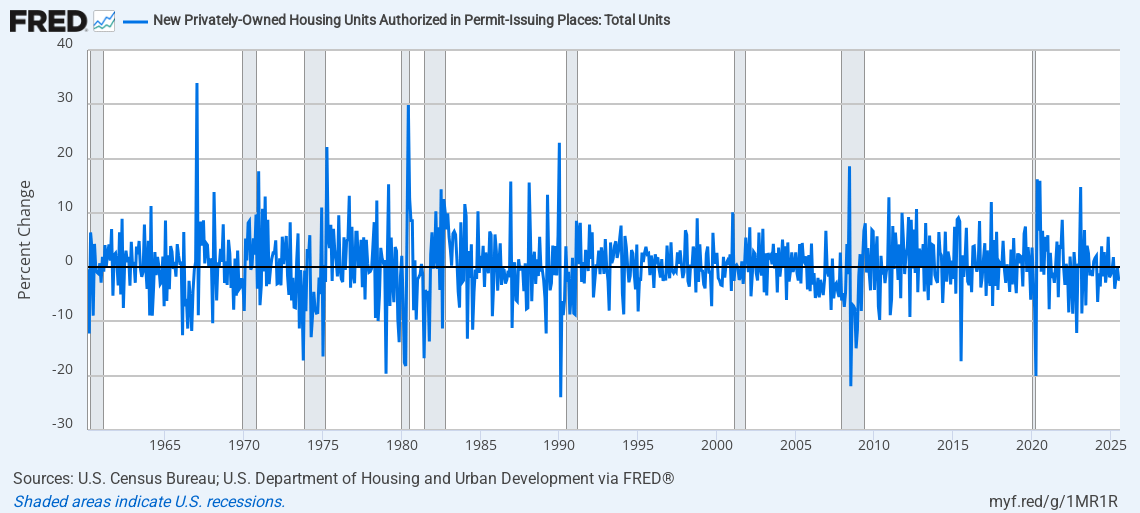

4. Building Permits

Housing leads the economy both into and out of recessions with remarkable consistency. Building permits-which measure planned construction activity-serve as an excellent forward-looking gauge of housing sector health.

Because housing impacts so many parts of the economy (construction, materials, furnishings, appliances, etc.), building permit trends often forecast broader economic shifts 6-9 months in advance.

How to use it: Monitor the year-over-year percentage change in building permits. Sustained declines of 10% or more have historically preceded economic weakness and market stress.

Real-world application: Building permits began falling sharply in late 2005 and early 2006, well before the housing crisis and subsequent market collapse. Traders who understood this leading relationship reduced exposure to housing-related sectors early.

Historical building permit data reveal a clear pattern: sustained declines of 10% or more often precede recessions and market corrections by several months. Housing activity consistently leads the broader economy both into and out of downturns.

5. Consumer Confidence Index

Consumer spending drives roughly 70% of U.S. economic activity, making consumer sentiment a critical leading indicator. The Consumer Confidence Index measures attitudes about current and future economic conditions.

What makes this indicator particularly valuable is the gap between present situation and future expectations components. When expectations drop significantly below current conditions, consumers are signaling trouble ahead.

How to use it: Watch for divergences between present conditions and expectations. When expectations decline sharply while present conditions remain stable, it often precedes market corrections by 3-6 months.

Real-world application: In early 2020, consumer expectations plummeted while present conditions remained relatively stable-a classic warning sign that appeared before the full market impact of the pandemic was felt.

6. Leading Credit Indicators

Credit availability drives economic cycles. Two key metrics provide early warnings of changing credit conditions: the Senior Loan Officer Opinion Survey on Bank Lending Practices and high-yield bond spreads.

The Fed's Senior Loan Officer Survey reveals whether banks are tightening or loosening lending standards. Meanwhile, expanding spreads between high-yield bonds and Treasuries signal increasing fear about corporate default risks.

How to use it: When loan officers report tightening standards for two consecutive quarters, or when high-yield spreads widen by more than 150 basis points from recent lows, defensive positioning becomes prudent.

Real-world application: High-yield spreads began widening dramatically in January 2020, weeks before the broader market acknowledged the pandemic's economic threat. Traders who monitored credit indicators had a valuable head start in risk management.

7. The Conference Board Leading Economic Index (LEI)

For traders seeking a comprehensive leading indicator, the Conference Board's LEI combines ten different economic metrics into a single index designed to forecast economic activity 6-9 months ahead.

Components include metrics we've already covered (like building permits and consumer expectations) alongside others like stock prices, manufacturing hours, and interest rate spreads.

How to use it: Three consecutive monthly declines in the LEI have historically signaled high probability of economic contraction within the next year. This pattern has preceded every recession since the index's creation.

Real-world application: The LEI began declining in February 2022 and continued falling throughout the year, correctly signaling the economic challenges that emerged as inflation persisted and growth slowed.

8. Baltic Dry Index (BDI)

Global trade activity offers powerful forward-looking economic signals, and the Baltic Dry Index-which measures shipping rates for dry bulk commodities like iron ore, coal, and grain-provides unique insights into global demand.

Because shipping rates are determined purely by supply and demand dynamics without speculative influence, significant BDI movements often precede changes in industrial production and commodity prices.

How to use it: Sustained 40%+ declines in the BDI often signal weakening global industrial demand, particularly in China and other manufacturing hubs. Conversely, sharp rises may indicate strengthening economic activity before it appears in official data.

Real-world application: The BDI collapsed by over 90% between May and December 2008, dramatically illustrating the severity of the global economic contraction before many other indicators fully reflected the crisis.

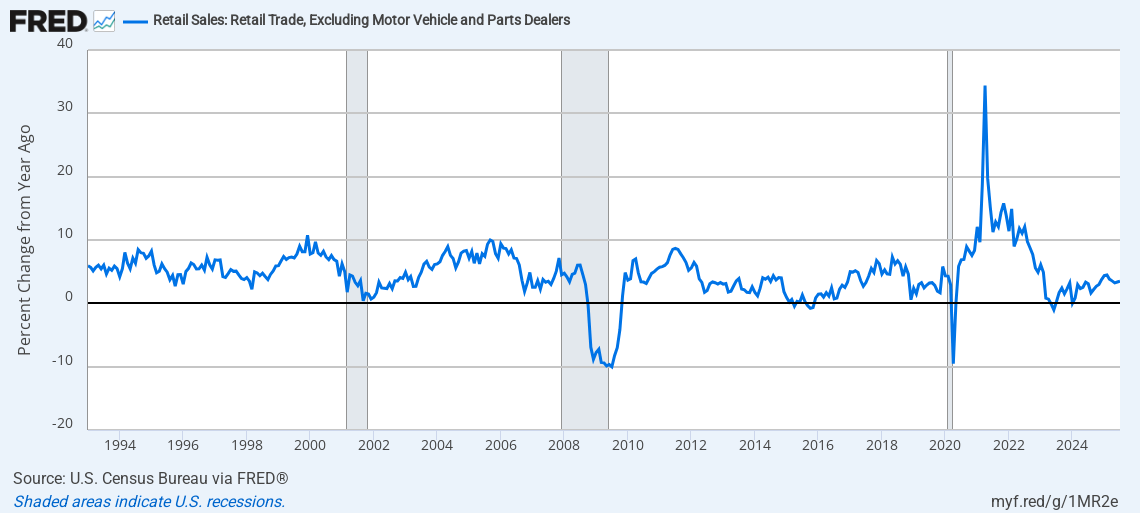

9. Retail Sales (Excluding Auto)

Retail sales directly measure consumer spending activity, but removing the volatile auto component creates a clearer signal of underlying consumption trends.

This indicator gains predictive power when viewed on a real (inflation-adjusted) basis. When real retail sales growth turns negative for multiple months, consumer retrenchment often follows-typically preceding market corrections.

How to use it: Calculate the year-over-year percentage change in inflation-adjusted retail sales excluding autos. When this figure turns negative for two consecutive months, economic weakness typically follows within 3-6 months.

Real-world application: Real retail sales growth began weakening significantly in mid-2022, providing early warning of the consumer spending slowdown that emerged later in the year and into 2023.

Real retail sales excluding autos highlight key turning points in consumer demand. Deep declines in 2009 and 2020 marked major recessions, while more recent weakness since mid-2022 signaled the beginning of a broader slowdown in spending.

10. Corporate Profit Margins

While many traders focus on earnings growth, profit margins provide a more forward-looking perspective on business health. Margin trends tend to lead revenue trends, making them valuable predictors of future corporate performance.

When profit margins peak and begin contracting across multiple sectors, it typically signals broader earnings weakness ahead, even if revenues remain temporarily strong.

How to use it: Monitor the quarterly change in economy-wide profit margins as reported in GDP data or S&P 500 aggregate margins. Three consecutive quarters of margin compression often precedes market corrections.

Real-world application: Corporate margins peaked in mid-2021 before beginning a multi-quarter decline, providing early warning of the earnings challenges that would emerge throughout 2022.

How to Integrate Leading Indicators Into Your Trading Strategy

Understanding these indicators is one thing; applying them effectively is another. Here's a practical framework:

1. Create a Leading Indicator Dashboard

Develop a simple scoring system for each indicator (improving, stable, or deteriorating). A comprehensive dashboard helps identify when multiple indicators are signaling similar economic shifts.

For example, when 6+ indicators turn negative, history suggests significant economic challenges ahead. Conversely, when multiple indicators improve from negative territory, economic recovery often follows.

2. Align Position Sizing with Indicator Signals

Use leading indicator readings to adjust your risk exposure. When indicators signal economic expansion, consider larger position sizes in growth-oriented assets. When they deteriorate, reduce overall exposure and shift toward defensive positions.

This doesn't mean attempting to time exact market tops and bottoms-rather, it's about gradually adjusting risk levels as economic conditions evolve.

3. Sector Rotation Based on Indicator Trends

Different sectors perform differently based on where we stand in the economic cycle. Use leading indicators to guide sector allocation:

Early-cycle improvement: Focus on consumer discretionary, financials, and industrials

Mid-cycle strength: Technology, communication services, and materials typically outperform

Late-cycle deterioration: Shift toward utilities, consumer staples, and healthcare

4. Combine with Technical Analysis

Leading indicators tell you what might happen economically, while technical analysis helps identify when markets are responding. The most powerful signals occur when economic indicators and technical patterns align.

For example, if multiple leading indicators suggest economic weakening while major indices form topping patterns, the probability of significant downside increases substantially.

Common Mistakes When Using Leading Indicators

In my years of trading and teaching others, I've seen several consistent errors when working with economic indicators:

Mistake 1: Expecting Perfect Timing

Leading indicators forecast economic shifts, not exact market turning points. The lag between indicator signals and market responses varies widely-sometimes markets anticipate economic changes, while other times they react only after changes materialize.

Solution: Use indicators to gradually adjust exposure rather than making binary in/out decisions.

Mistake 2: Focusing on a Single Indicator

No individual indicator is infallible. Even the yield curve, with its impressive historical record, has produced occasional false signals.

Solution: Look for confirmation across multiple indicators before making significant strategy changes.

Mistake 3: Ignoring Global Context

In today's interconnected economy, domestic indicators alone provide an incomplete picture. A deteriorating U.S. housing market might be offset by strengthening conditions in Europe or Asia.

Solution: Include global indicators in your analysis, particularly for markets or securities with international exposure.

Mistake 4: Fighting the Fed

Monetary policy often overrides traditional economic signals in the short term. When central banks are aggressively easing, markets may rise despite deteriorating fundamentals (and vice versa).

Solution: Always consider indicator readings within the context of current monetary policy direction and intensity.

Putting It All Together: A Real-World Approach

Here's how I integrate these leading indicators into an actionable trading framework:

Monthly review of all ten indicators to identify overall economic direction

Weekly monitoring of high-frequency indicators (jobless claims, credit spreads) for signs of changing trends

Quarterly portfolio rebalancing based on the prevailing indicator signals

Immediate risk adjustment when three or more indicators show significant deterioration within a short timeframe

This systematic approach prevents emotional reactions to market volatility while ensuring my positioning reflects underlying economic reality.

The Bottom Line for New Traders

Leading economic indicators won't make you a market psychic, but they provide something perhaps more valuable: context. They help explain why markets are moving and offer probabilistic guidance about future economic conditions.

For new traders especially, this framework transforms seemingly random market movements into understandable patterns connected to economic fundamentals. Instead of trading based on headlines or emotions, you'll develop the confidence that comes from deeper economic understanding.

Mastering these ten leading indicators requires time and practice. Start by monitoring just two or three that resonate with your trading style, then gradually expand your analysis as your comfort level increases.

Remember that no indicator works perfectly in every market environment. The goal isn't prediction with perfect accuracy, but rather tilting probabilities in your favor by understanding the economic currents moving beneath market surfaces.

What leading indicators have you found most valuable in your own trading? I'm curious to hear which economic signals have helped you navigate market complexity most effectively.

Kamil - Markets&Manners

More on leading indicators: What Do Leading Indicators Say About the Economy? A Trader's Guide

Important measures:

Expected Value in Trading: Measuring Your Strategy’s Real Potential